Ohio Becomes Third U.S. State to Propose Bitcoin Reserves for State Treasury

An Ohio lawmaker has proposed a bill to create a Bitcoin fund within the state treasury, making Ohio the third U.S. state in just over a month to consider such legislation.

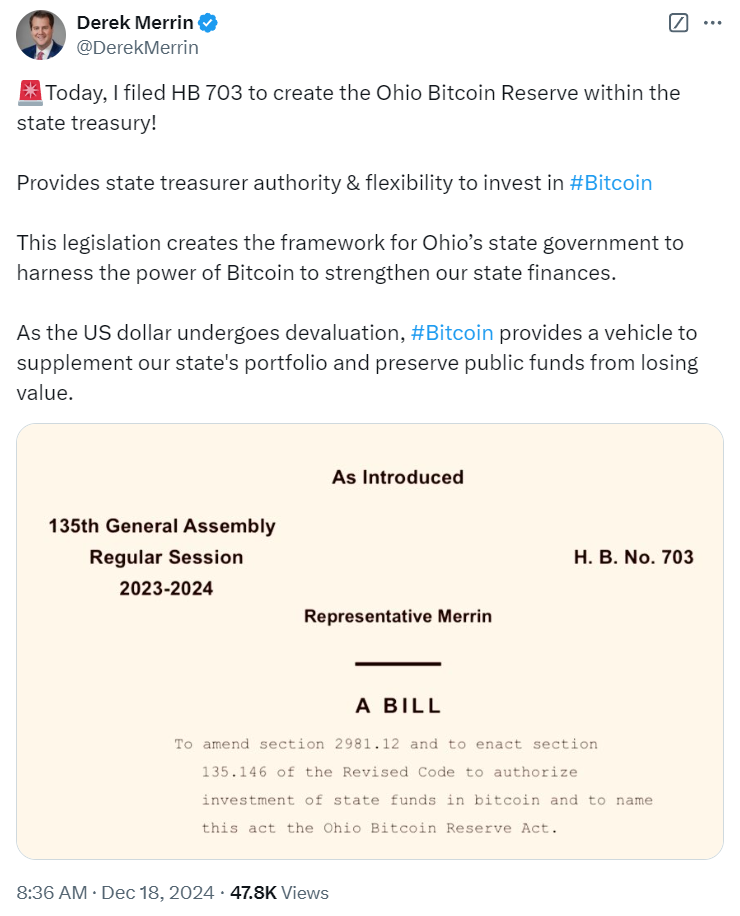

On Dec. 17, Ohio House Republicans leader Derek Merrin introduced HB 703, known as the Ohio Bitcoin Reserve Act. The bill would grant the state treasurer the authority to invest in Bitcoin as part of a strategic asset allocation plan, though it does not mandate Bitcoin purchases.

“The U.S. Dollar is being rapidly devalued, and our State Treasurer should have the authority and flexibility to invest in Bitcoin when determining proper asset allocation,” Merrin stated. “Ohio must embrace technology and protect tax dollars from eroding.”

Ohio House Republicans leader Derek Merrin has introduced HB 703, the Ohio Bitcoin Reserve Act, as a foundational framework for future legislative action, acknowledging its limited timeline in the current session. With the 135th General Assembly set to adjourn on Dec. 31, the bill will need to be reintroduced in the 136th General Assembly, starting Jan. 6, 2025, as unenacted bills expire at the end of each session.

Merrin expressed optimism about the bill’s prospects, stating it aims to expedite legislative discussions in the next session. “Bitcoin is revolutionizing finance and will reshape world economies. We must have sound money — it’s like digital property rights for everyone who owns it. This legislation sets up the framework for Ohio’s state government to harness the power of Bitcoin and strengthen our state finances,” Merrin said.

Known as a vocal advocate for cryptocurrency, Merrin holds a top-tier “A” rating from Coinbase’s Stand With Crypto initiative. In an August LinkedIn post, he emphasized the importance of creating a “21st century framework” to safeguard individuals’ rights to own, trade, and conduct commerce with digital assets.

Texas and Pennsylvania have joined Ohio in exploring Bitcoin reserves for state treasuries, following Donald Trump’s presidential election victory in November. Trump has even floated the concept of a federal Bitcoin reserve.

On Dec. 12, Texas House Representative Giovanni Capriglione introduced the “Texas Strategic Bitcoin Reserve Act.” This legislation proposes that the state comptroller hold Bitcoin as a reserve asset for a minimum of five years, highlighting Bitcoin’s potential for long-term value retention.

A month earlier, on Nov. 12, Pennsylvania House Representative Mike Cabell introduced a bill allowing its treasury to allocate up to 10% of its balance sheet to Bitcoin. Cabell argued that Bitcoin could serve as a hedge, offering stability amid economic uncertainty.